Ryan Smith

Ryan Smith

News Managing Editor

587 Published Articles 904 Edited Articles

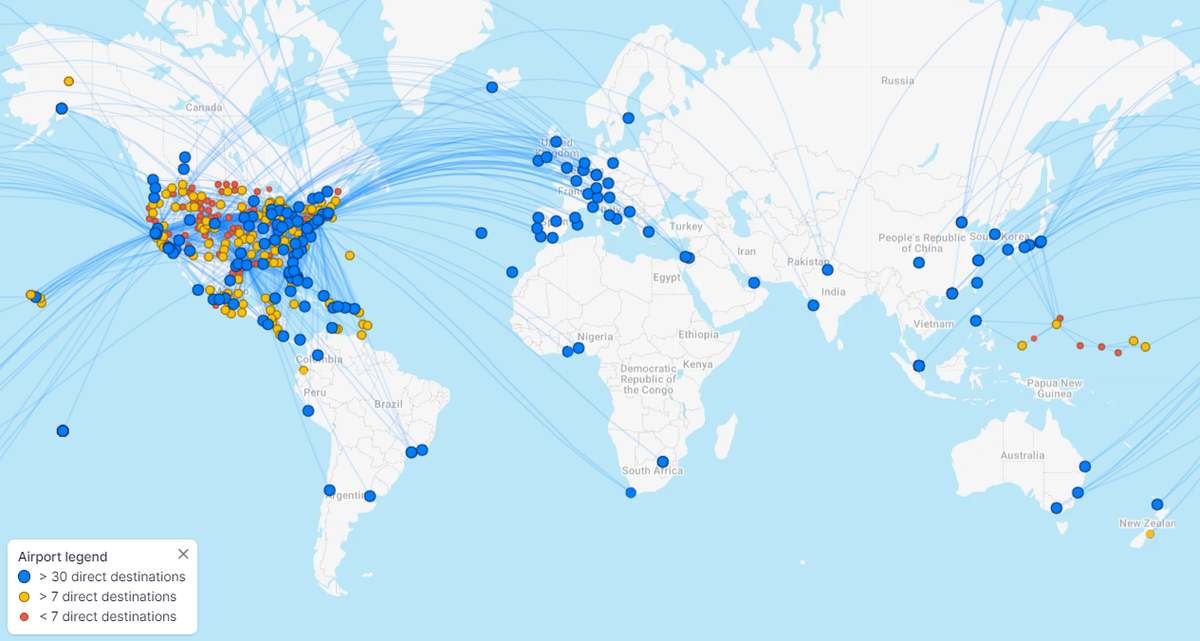

Countries Visited: 197U.S. States Visited: 50

Ryan completed his goal of visiting every country in the world in December of 2023 and is letting his wife choose their destinations, including revisiting some favorites. Over the years, he’s written ...

Edited by: Keri Stooksbury

Keri Stooksbury

Editor-in-Chief

70 Published Articles 3693 Edited Articles

Countries Visited: 54U.S. States Visited: 28

Editing with Upgraded Points for over 6 years, as editor-in-chief, Keri manages the editorial calendar and oversees the efforts of the editing team and over 20 content contributors, reviewing thousand...