Great Card If

- You’re not loyal to a specific hotel chain or airline

- You want a card with multiple redemption options, including transfer partners

- You want a card that makes earning rewards easy with 2x miles on all purchases

- You want a card with purchase protections and auto rental insurance

Don’t Get If

- You prefer cash-back over travel rewards

- You’re loyal to a specific hotel chain or airline

- You prefer a card with luxury travel benefits like airport lounge access or hotel elite status

- You prefer a card with no annual fee

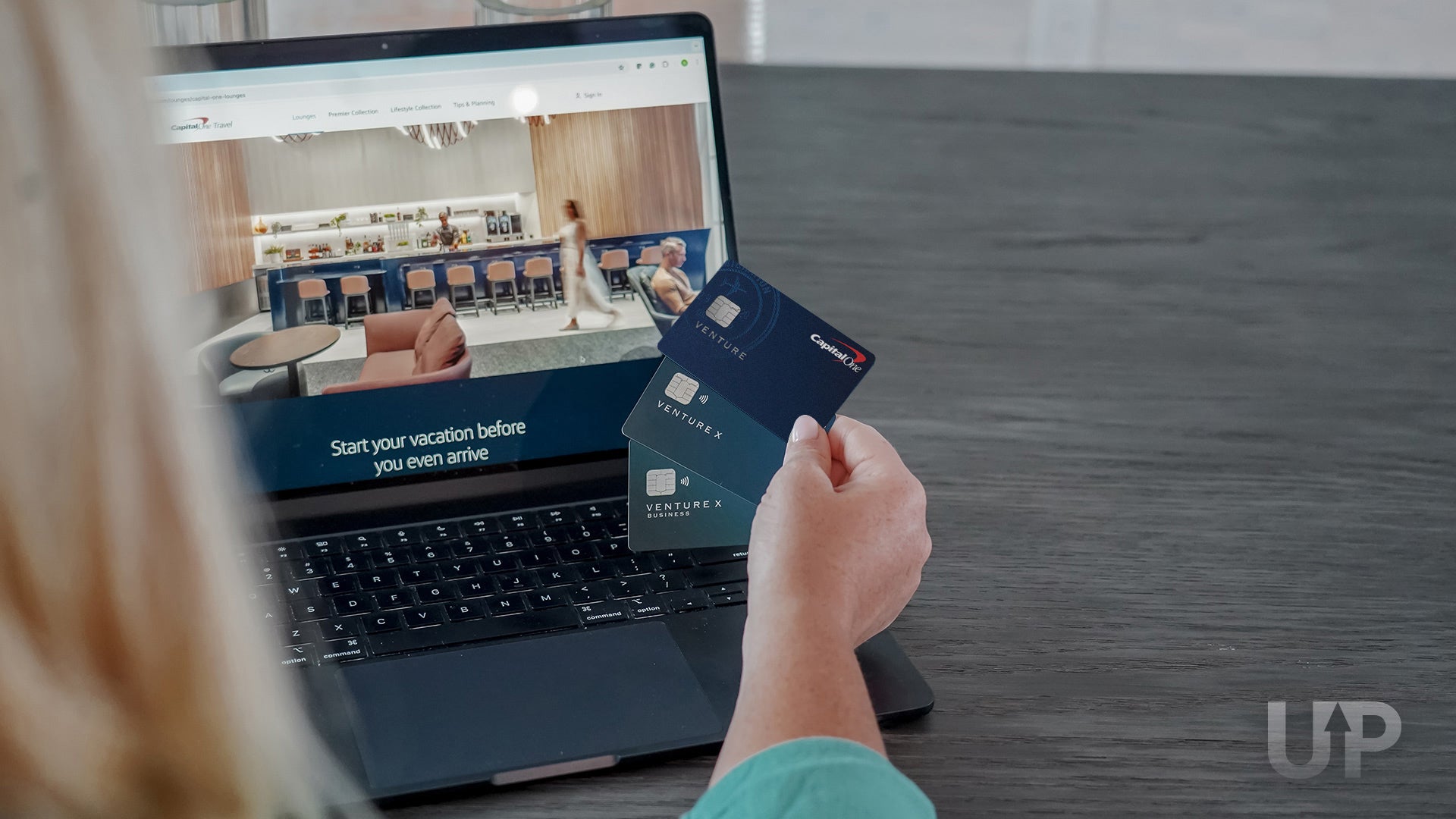

Capital One Venture Card — Is It Worth It?

The Capital One Venture card can be great if you want a solid all-around travel card with a low annual fee, no foreign transaction fees, and excellent points-earning rates (rates & fees). Further, since it earns an uncapped 2x miles on every purchase, it’s one of the best cards for monthly bills. That’s what Juan Ruiz, Upgraded Points compliance editor and content contributor, loves most about the card:

“For non-bonus spending, I use the Capital One Venture card. Because it earns 2x miles on all purchases, I use this card for niche spending categories that aren’t commonly found with other credit cards, such as paying HOA fees or shopping at furniture stores.”

Juan Ruiz, compliance editor and content contributor

The card features other perks, including auto rental insurance, and a Global Entry or TSA PreCheck application fee credit.

To sweeten the deal even further, you can transfer miles earned with your Capital One Venture card to several different airline partners. Cardholders can get outsized value from their Capital One miles by transferring to airlines for business and first class flight redemptions.

Capital One Venture Card Top Benefits

Card Protections

Your Capital One Venture card gives you the following protections:

- Travel Assistance Services – Available 24/7 to help connect you with local emergency and assistance resources when you’re away from home.

- MasterRental Insurance – Use your card to rent an eligible vehicle, and you may be covered for physical damage and theft of the rental vehicle.

- Purchase Assurance – Doubles the time period of your covered purchase’s original warranty, up to a maximum of twenty-four months.

Does the Capital One Venture Card Cover Global Entry or TSA PreCheck?

Yes, the Capital One Venture card gives you up to a $120 credit toward your application for Global Entry or TSA PreCheck.

Since you can get either service covered thanks to this credit, we recommend you apply for Global Entry as it includes TSA PreCheck as well, while TSA PreCheck alone does not include Global Entry.

Best Ways To Earn and Redeem Your Capital One Miles

As a transferable rewards currency, Capital One Miles is quite valuable for rewards travelers looking to book top-notch travel experiences. Given that, it’s only natural that you’ll want to learn all of the ways to earn as many Capital One miles as possible. Our guide shows you how to do just that.

Once you’ve earned those miles, next up is making strategic use of them so you can book first and business class flights, along with 5-star hotel stays, for a fraction of what the cash cost would normally be. To learn some of the top strategies, read through our guide on the best ways to redeem Capital One miles.

Alternative Cards to the Capital One Venture Card

The Chase Sapphire Preferred card is one of the most popular travel rewards cards on the market, and with benefits like 5x points on travel purchased through Chase Travel, 3x points on dining, 2x points on all other travel purchases, no foreign transaction fees, and flexible redemption options (including transfer partners), it’s easy to see why the card is so popular.

You’ll be able to start earning Chase Ultimate Rewards points, one of the most valuable loyalty currencies available. Chase Ultimate Rewards points can be redeemed for incredible value through various transfer partners.

The Bank of America Premium Rewards card can be a great option for travelers, especially for those who already have a relationship with the bank.

Cardholders earn 2x points on travel and dining purchases, plus 1.5x points on all other purchases. Customers can also earn even higher point multipliers on these categories, depending on the balance of their checking, savings, and investment accounts with Bank of America.

The Bank of America Premium Rewards card does not feature transfer partners, and all points are worth a fixed 1 cent per point toward travel purchases. If you already have a banking relationship with Bank of America and prefer a fixed-point redemption, this card could be a good option for you.

Check out our comparisons of the Capital One Venture card and a number of these popular cards:

UP’s Card Review Methodology

Every card we review is assigned a "U.P. Rating" – our star-based system that encompasses all the key details to showcase a card’s standout features, where it falls short, and how it stacks up for travelers to maximize rewards.

These ratings range from 0 to 5 stars and are determined by carefully weighing crucial factors like:

- Bonus categories

- Benefits and perks

- Quality of associated loyalty programs

- Annual fees and other costs

- Size of the welcome bonus (and relative to the annual fee)

- And several more

You can learn more about how Upgraded Points reviews and rates credit cards.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

![Capital One QuicksilverOne Cash Rewards Card — Full Review [2025]](https://upgradedpoints.com/wp-content/uploads/2018/03/Capital-One-QuicksilverOne-Card.png?auto=webp&disable=upscale&width=1200)

![Capital One VentureOne Rewards Credit Card – Full Review [2025]](https://upgradedpoints.com/wp-content/uploads/2018/03/VentureOne-Card-Art.webp?auto=webp&disable=upscale&width=1200)

![Capital One Quicksilver Cash Rewards Credit Card — Full Review [2025]](https://upgradedpoints.com/wp-content/uploads/2018/02/Capital-One-Quicksilver-Card.png?auto=webp&disable=upscale&width=1200)

![The Best Capital One Credit Cards for Travel Rewards, Cash-Back, and More [July 2025]](https://upgradedpoints.com/wp-content/uploads/2022/12/Capital-One-Venture-One-Upgraded-Points-1c-1.jpg?auto=webp&disable=upscale&width=1200)