Great Card If

- Your business spending falls within the bonus categories

- You want a card that earns flexible rewards

- You want a card that keeps you covered with travel insurance and purchase protection

- You want a card with no annual fee

Don’t Get If

- You want a credit card that earns travel rewards, benefits, and perks

- Your business spending primarily falls outside of the bonus categories

Ink Business Cash Card — Is It Worth It?

The Ink Business Cash card is well worth it for small business owners with expenses that fall within the 5% and 2% back categories. Keep in mind, though, that these rewards are capped at $25,000 in combined purchases for each category. So if your business expenses are much larger, you may want to consider supplementing the Ink Business Cash card with additional rewards cards to further maximize your earnings.

However, if your business spending meets the $25,000 threshold for the 5% category, you could be earning, at minimum, $1,250 in cash-back each and every year, all from a card with no annual fee!

In addition, through September 30, 2027, cardholders earn a total of 5% cash-back on Lyft rides, which is great when traveling for business.

The Ink Business Cash card becomes even more compelling when paired with a premium Chase Ultimate Rewards card, which is a strategy that Upgraded Points Content Contributor Senitra Horbrook, uses with her card:

“The Ink Business Cash card helps me increase my balance of Ultimate Rewards points, especially since it earns 5x points on office supply stores and on internet, cable and phone services on the first $25,000 spent per year. I also have the Chase Sapphire Preferred® Card, which allows me to combine my points from the Ink Business Cash card with it and transfer those points to lots of great travel partners.”

Senitra Horbrook, content contributor

Ink Business Cash Card Top Benefits

No-Cost Employee Cards

If you have multiple employees, it can be a major hassle to have to pass 1 company card back and forth. Fortunately, the Ink Business Cash card allows you to add as many employee cards as you’d like for no added cost.

Travel and Purchase Coverage

The Ink Business Cash card keeps your purchases covered with the following protections:

- Purchase Protection: When you purchase an item with your card, it’s covered for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- Extended Warranty Coverage: Items you purchase with your card that have warranties of 3 years or less have the warranty extended by an additional year.

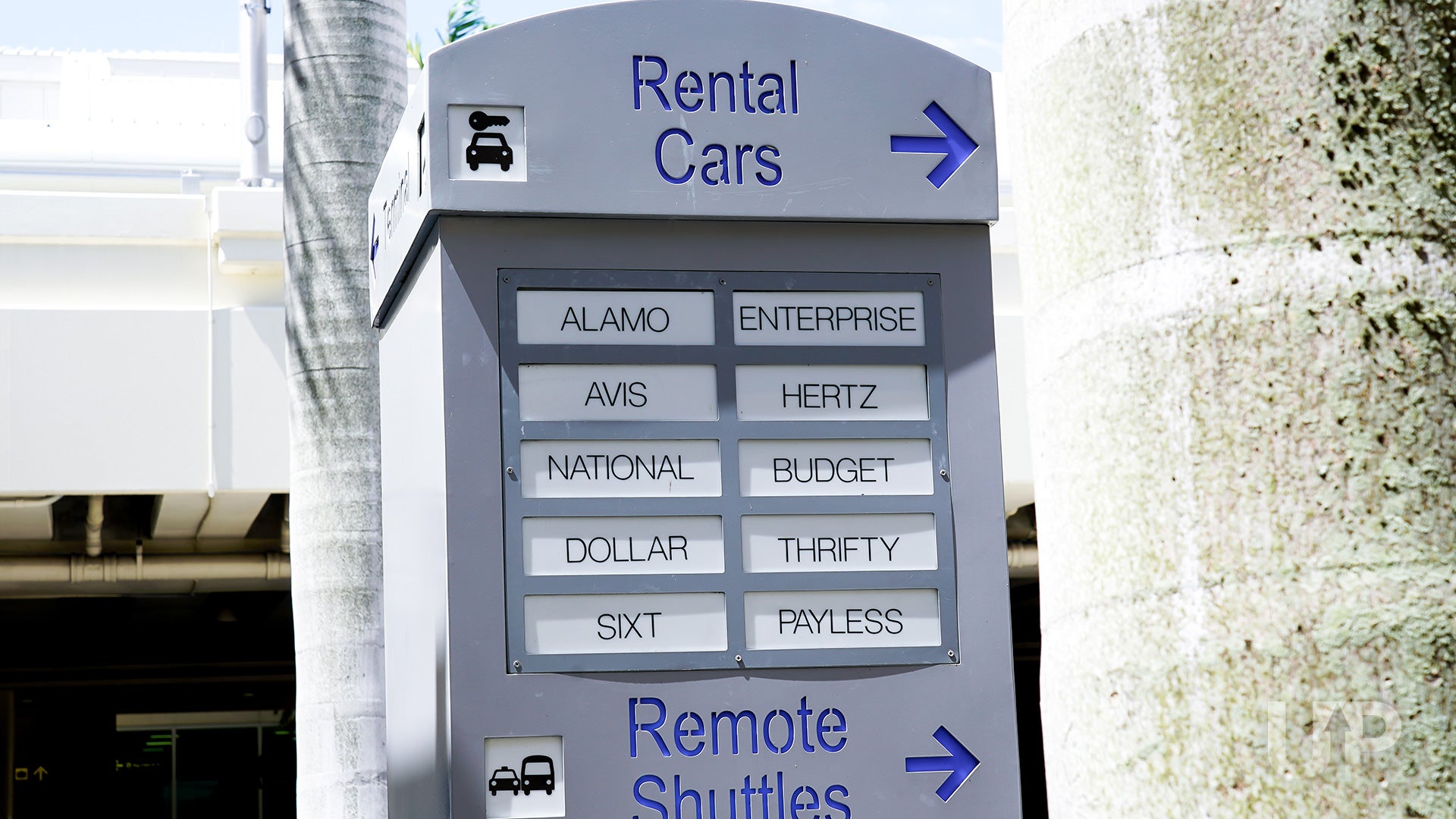

- Rental Car Insurance: You’ll get secondary coverage that keeps you covered in case of theft or damage to your rental car.

Best Ways To Earn and Redeem Your Chase Points

When you earn cash-back with your Ink Business Cash card, it comes in the form of Chase Ultimate Rewards points. But you should know that using your card isn’t the only way to earn lots of Chase Ultimate Rewards points!

You might think, since the Ink Business Cash is traditionally a cash-back card, that redeeming for cash-back is your only option — but that isn’t true!

In fact, if you pair your Ink Business Cash card with a card that has access to Chase transfer partners, like the Ink Business Preferred® Credit Card, the Chase Sapphire Reserve®, or the Chase Sapphire Preferred® Card, you’ll find that there are many great ways to redeem your Chase Ultimate Rewards points for huge travel value!

Alternative to the Ink Business Cash Card

The Amex Blue Business Cash card offers 2% cash-back on all eligible purchases for up to $50,000 per calendar year, then 1%. Cash-back earned is automatically credited to your statement.

We’ve compared the Ink Business Cash card to some other popular cards:

UP’s Card Review Methodology

Every card we review is assigned a "U.P. Rating" – our star-based system that encompasses all the key details to showcase a card’s standout features, where it falls short, and how it stacks up for travelers to maximize rewards.

These ratings range from 0 to 5 stars and are determined by carefully weighing crucial factors like:

- Bonus categories

- Benefits and perks

- Quality of associated loyalty programs

- Annual fees and other costs

- Size of the welcome bonus (and relative to the annual fee)

- And several more

You can learn more about how Upgraded Points reviews and rates credit cards.

![Ink Business Preferred Credit Card – Full Review [2026]](https://upgradedpoints.com/wp-content/uploads/2018/12/Ink-Business-Preferred.jpeg?auto=webp&disable=upscale&width=1200)

![The JetBlue Business Card — Full Review [2025]](https://upgradedpoints.com/wp-content/uploads/2018/03/JetBlue-Business-Card-1.png?auto=webp&disable=upscale&width=1200)

![Marriott Bonvoy Boundless Credit Card — Full Review [2026]](https://upgradedpoints.com/wp-content/uploads/2020/01/marriott_bonvoy_boundless_card.png?auto=webp&disable=upscale&width=1200)

![Ink Business Unlimited Credit Card — Full Review [2026]](https://upgradedpoints.com/wp-content/uploads/2020/09/Ink-Business-Unlimited.jpeg?auto=webp&disable=upscale&width=1200)