Juan Ruiz

Juan Ruiz

Senior Editor & Content Contributor

792 Published Articles 1087 Edited Articles

Countries Visited: 52U.S. States Visited: 34

Juan Ruiz is a leading travel journalist and expert in credit cards and loyalty programs. For over a decade, he has turned complex rewards and travel strategies into clear, actionable insights. His wo...

Edited by: Michael Y. Park

Michael Y. Park

Senior Editor and Content Contributor

65 Published Articles 1675 Edited Articles

Countries Visited: 60+U.S. States Visited: 50

Michael Y. Park is a journalist living in New York City. He’s traveled through Afghanistan disguised as a Hazara Shi’ite, slept with polar bears on the Canadian tundra, picnicked with the king and que...

& Kellie Jez

Kellie Jez

Director of Operations

6 Published Articles 1233 Edited Articles

Countries Visited: 10U.S. States Visited: 20

Kellie’s professional experience has led her to a deep passion for compliance, data reporting, and process improvement. Kellie’s learned the ins and outs of the points and miles world and leads UP’s c...

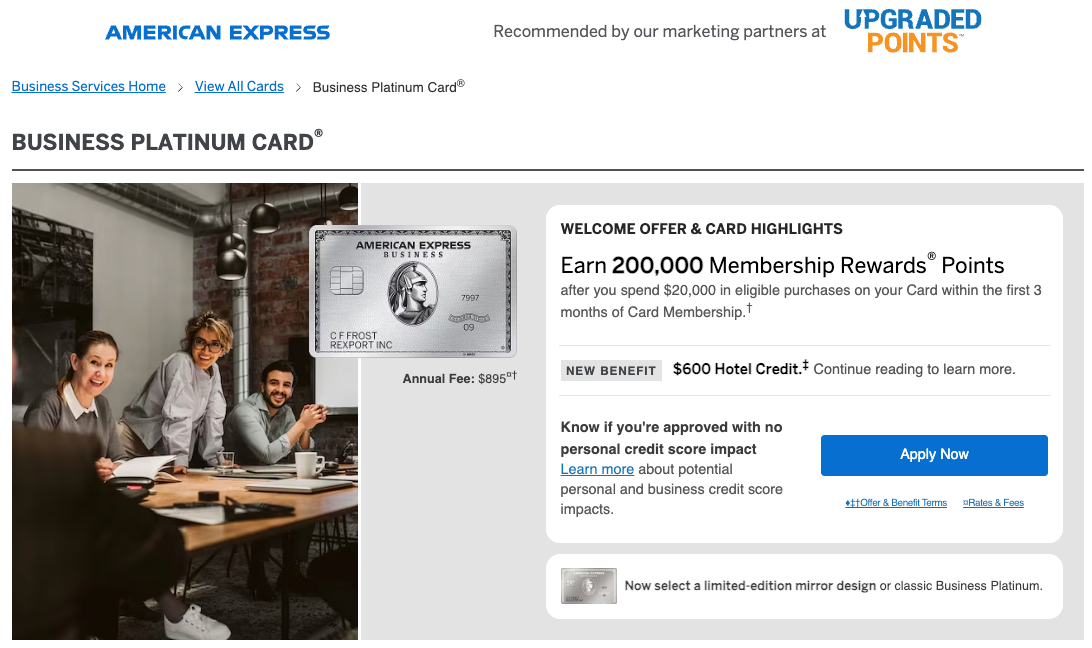

![Get an Incredible 200K Points With the Amex Business Platinum [New Public Offer]](https://upgradedpoints.com/wp-content/uploads/2021/10/Amex-Business-Platinum-Card-rocks.jpg?auto=webp&disable=upscale&width=1200)